Further, this increase in machinery and the decrease in cash are to be recorded in the machinery account and cash account respectively. Suppose we purchase machinery for the cash, this transaction will increase the machinery and decrease cash because machinery comes in and cash goes out of the business. As talked about earlier, the right-hand side (Cr) records credit transactions and the left-hand side (Dr) records the debit transaction. So, a ledger account, also known as a T-account, consists of two sides. To compress, the debit is 'Dr' and the credit is 'Cr'. Third: Debit the Receiver, Credit the giver. Second: Debit all expenses and credit all incomes and gains. Before we examine further, we should know the three famous golden rules of accountancy:įirst: Debit what comes in and credit what goes out. The golden rules of accountancy govern the rule of debit and credit. The debit is passed when an increase in assets or decrease in liabilities and owner’s equity occurs.Ĭredit is passed when there is a decrease in assets or an increase in liabilities and owner’s equity. Given below is a comparison chart to have a thorough understanding of the difference between the concept of debit and credit. In the ‘Purchase of a new computer, the expense (payment for the computer) is credited on the right side of this expense account. Whilst the right side is marked by the credit entry, it either increases equity, liability, or revenue accounts or decreases an asset or expense account. Here, the asset gained (computer) is to be notified on the left side of the asset account. For example, ‘Purchase of a new computer.

It increases an asset or expenses account or decreases equity liability or revenue accounts. However, we use this opposite treatment to get the desired result.Ī left-sided entry is headed with debit.

Now to increase that particular account, we simply credit it. It is quite amusing that debits and credits are equal yet opposite entries.

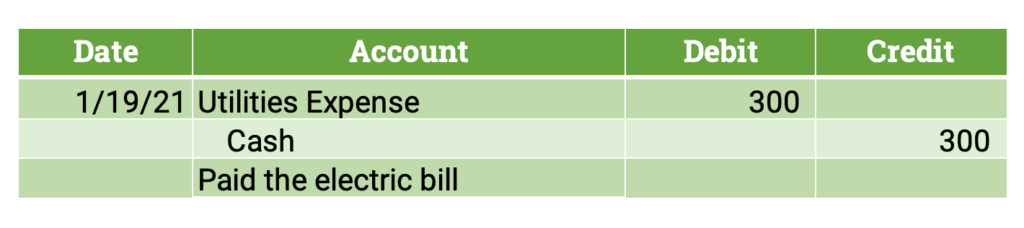

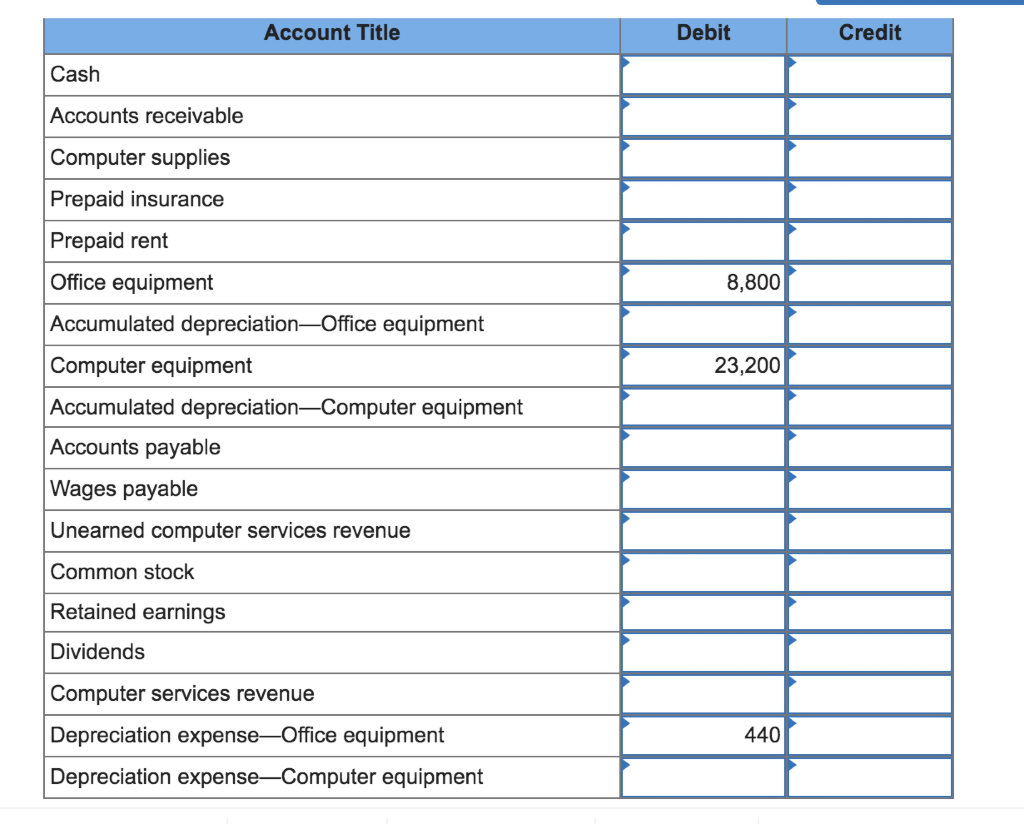

If the debit is applied to any of these accounts, the account balance will be decreased. Liabilities, revenues, and equity accounts have a natural credit balance. In effect, a debit increases an expense account in the income statement and a credit decreases it. The commonly affected accounts are-ĭifferent Effects of Debit and Credit are as Follows The business transaction is separated into accounts while doing the bookkeeping. In contrast, if the debt is not equal to the credit, creating a financial statement will be a problem. 'In balance' is such an accounting transaction where the total of the debit and credit matches or is equal. Whenever accounting transactions take place, it majorly affects these two accounts. While keeping an account of this transaction, these accounting tools, debit, and credit, come into play. These are the events that carry a monetary impact on the financial system. Business transactions are to be recorded and hence, two accounts, which are debit and credit, get facilitated.

In this context, we will delve deep into the discussion of debit and credit in accounting, know its effect in the accounting transaction of a business, know the rules engaging debit and credit, journal entries in effect to it.ĭebit and Credit are the two accounting tools. You might be wondering what is debit and credit? Also, this is intriguing enough why is it that if we debit some accounts, it makes them go up while when some other sets of accounts get debited, it goes down? More importantly, how is this important for any business? In a nutshell, recording all the money flowing into the account is the basis of debit while recording all the money flowing out of the account is the basis of credit. An accounting expression starts with 'Debit' and 'Credit'.

0 kommentar(er)

0 kommentar(er)